Personal ICS & CDARS

ICS, the IntraFi Cash ServiceSM, and CDARS are smart, convenient ways to safeguard your large deposits. With ICS, your funds are placed into demand deposit accounts, money market deposit accounts, or both. With CDARS, funds are placed into CDs1. With ICS and CDARS services, you can:

Enjoy Peace of Mind Relax knowing that your funds are eligible for multi-million-dollar FDIC insurance, protection that’s backed by the full faith and credit of the United States government. No one has ever lost a penny of FDIC-insured deposits. Save Time Work directly with us―a bank you know and trust―to access multi-million-dollar FDIC insurance, and say ‘goodbye’ Maintain Flexibility Enjoy access to funds placed into money market deposit accounts. Earn Interest Earn one interest rate. Support Your Community Feel good knowing that the full amount of your funds placed through ICS can stay local to support lending opportunities that build a stronger community.

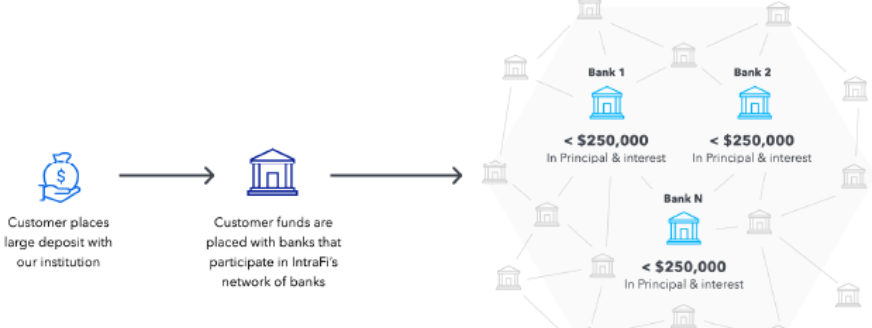

Through just one bank relationship, you can access FDIC insurance from many.

Institutions, like ours, that offer ICS and CDARS are members of the IntraFi network. When we place your funds through the ICS or CDARS service, that deposit is divided into amounts under the standard FDIC insurance maximum of $250,000. The funds are then placed in demand deposit accounts or money market deposit accounts (using ICS), or in CDs (using CDARS) at multiple banks. As a result, you can access coverage from many institutions while working directly with just one. You receive one regular statement from our bank for each service in which you participate, and, as always, your confidential information is protected.

To get started, we will work with you following the steps below.

Personal ICS & CDARS

What are ICS And CDARS?

Why Personal ICS and CDARS?

to tracking collateral on an ongoing basis, managing multiple bank relationships, manually consolidating bank statements, and other

time-consuming workarounds.

How Do ICS And CDARS Work?

Follow These Straightforward Steps

ICS

CDARS

When you choose ICS, you gain access to the Depositor Control Panel. You can check your ICS balances, view where your funds could be placed, review and manage daily proposed fund placements, track monthly program withdrawals, and view your transaction history.

Interested in learning more? Contact a local branch professional today or stop into any of our six locations!

[1] Deposit placement through CDARS or ICS is subject to the terms, conditions, and disclosures in applicable agreements. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one destination bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA (e.g., before settlement for deposits or after settlement for withdrawals) or be uninsured (if the placing institution is not an insured bank). The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through CDARS or ICS satisfies any restrictions on its deposits. A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks. The depositor may exclude banks from eligibility to receive its funds. IntraFi, CDARS, One Bank One Rate One Statement are registered trademarks, and the IntraFi logo and IntraFi hexagon are service marks, of IntraFi Network LLC.

[2] When deposited funds are exchanged on a dollar-for-dollar basis with other institutions that use ICS, our bank can use the full amount of a deposit placed through ICS for local lending, satisfying some depositors’ local investment goals or mandates. Alternatively, with a depositor's consent, our bank may choose to receive fee income instead of deposits from other participating institutions. Under these circumstances, deposited funds would not be available for local lending.

Deposit placement through CDARS or ICS is subject to the terms, conditions, and disclosures in applicable agreements. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one destination bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA (e.g., before settlement for deposits or after settlement for withdrawals) or be uninsured (if the placing institution is not an insured bank). The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through CDARS or ICS satisfies any restrictions on its deposits. A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks. The depositor may exclude banks from eligibility to receive its funds. IntraFi, ICS, Insured Cash Service are registered service marks, and the IntraFi hexagon and IntraFi logo are service marks, of IntraFi Network LLC.

[3] Funds are placed into demand deposit accounts, money market deposit accounts, or both, when using ICS and into CDs using CDARS.

Source: Intrafi NetworkTM Marketing Resource Center

By continuing, you will be leaving the Woodsboro Bank's website and entering a website hosted by another party. Woodsboro Bank does not assume liability for the content, information, security, policies or transactions provided by other sites.